Research on Intelligent Audit System for Employee Expense Reimbursement Based on Agent Technology

DOI:

https://doi.org/10.62677/IJETAA.2512143Keywords:

Agent, Expense reimbursement, Intelligent audit, Rule engine, Financial automationAbstract

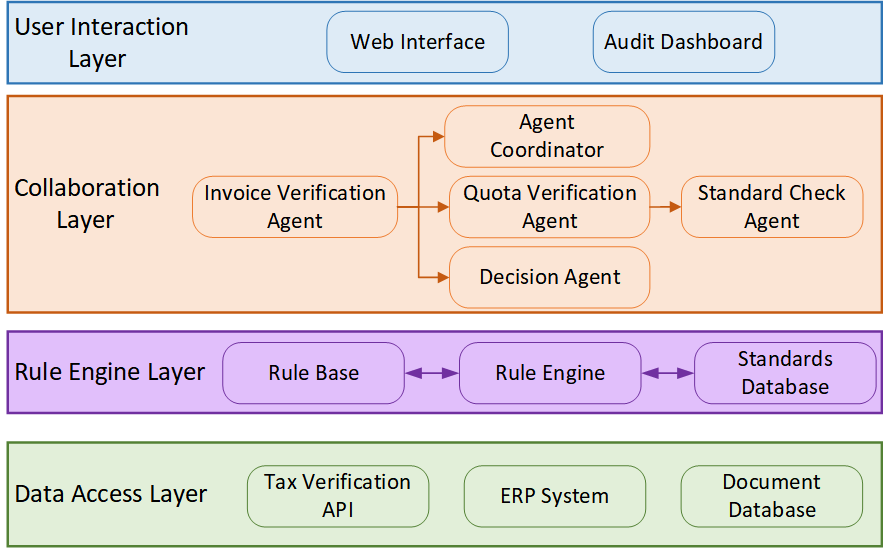

Expense reimbursement auditing is a high-frequency task in corporate finance departments, requiring auditors to verify invoice authenticity, expense compliance, and approval process integrity across multiple dimensions. This work is repetitive and prone to errors due to auditor fatigue. This paper proposes an intelligent expense reimbursement audit assistant based on agent technology to automate preliminary auditing tasks. The intelligent agent integrates three core functional modules: invoice verification, standard compliance checking, and quota verification. It automatically identifies invoice information from reimbursement documents and validates authenticity through tax authority interfaces, cross-checks expenses such as meals and travel against corporate standards to detect overages, and verifies whether cumulative reimbursement amounts exceed departmental budgets. The system employs a rule engine architecture rather than complex machine learning algorithms, enabling finance personnel to maintain audit rules independently without continuous IT support. In practical application at a consulting firm, the system reduced document auditing time from an average of 15 minutes to 5 minutes per claim, improved anomaly detection rate by 40%, and significantly reduced manual audit costs and compliance risks. This paper elaborates on key implementation aspects including audit rule base construction methods, common anomaly type identification logic, and human-machine collaborative audit process design, providing enterprises with a low-barrier, high-efficiency solution for financial digital transformation.

Downloads

References

J. Kokina, R. Gilleran, S. Blanchette, and D. Stoddard, "Accountant as digital innovator: Roles and competencies in the age of automation," Account. Horizons, vol. 35, no. 1, pp. 153–184, 2021. DOI: 10.2308/HORIZONS-19-145

A. R. Hasan, "Artificial intelligence (AI) in accounting & auditing: A literature review," Open J. Bus. Manag., vol. 10, no. 1, pp. 440–465, 2022. DOI: 10.4236/ojbm.2022.101026

G. Almufadda and N. Almezeini, "Artificial intelligence applications in the auditing profession: A literature review," J. Emerg. Technol. Account., vol. 19, no. 2, pp. 29–42, 2021. DOI: 10.2308/jeta-2020-083

A. A. Austin, T. D. Carpenter, M. H. Christ, and C. S. Nielson, "The data analytics journey: Interactions among auditors, managers, regulation, and technology," Contemp. Account. Res., vol. 38, no. 3, pp. 1888–1924, 2021. DOI: 10.1111/1911-3846.12680

S. Joshi, "Review of autonomous and collaborative agentic AI and multi-agent systems for enterprise applications," Int. J. Innov. Res. Eng. Manag., vol. 12, no. 3, pp. 65–76, 2025. DOI: 10.55524/ijirem.2025.12.3.9

D. Appelbaum, D. S. Showalter, T. Sun, and M. A. Vasarhelyi, "A framework for auditor data literacy: A normative position," Account. Horizons, vol. 35, no. 2, pp. 5–25, 2021. DOI: 10.2308/HORIZONS-19-127

A. Fedyk, J. Hodson, N. Khimich, and T. Fedyk, "Is artificial intelligence improving the audit process?" Rev. Account. Stud., vol. 27, pp. 938–985, 2022. DOI: 10.1007/s11142-022-09697-x

B. P. Commerford, S. A. Dennis, J. R. Joe, and J. W. Ulla, "Man versus machine: Complex estimates and auditor reliance on artificial intelligence," J. Account. Res., vol. 60, no. 1, pp. 171–201, 2021. DOI: 10.1111/1475-679x.12407

O. M. Lehner, K. Ittonen, H. Silvola, E. Ström, and A. Wührleitner, "Artificial intelligence based decision-making in accounting and auditing: Ethical challenges and normative thinking," Account. Audit. Account. J., vol. 35, no. 9, pp. 109–135, 2022. DOI: 10.1108/AAAJ-09-2020-4934

X. Yao, H. Sun, S. Li, and W. Lu, "Invoice detection and recognition system based on deep learning," Secur. Commun. Netw., vol. 2022, Article 8032726, 2022. DOI: 10.1155/2022/8032726

C. Estep, E. E. Griffith, and N. L. MacKenzie, "How do financial executives respond to the use of artificial intelligence in financial reporting and auditing?" Rev. Account. Stud., vol. 29, pp. 2798–2831, 2024. DOI: 10.1007/s11142-023-09771-y

F. Huang, W. G. No, M. A. Vasarhelyi, and Z. Yan, "Audit data analytics, machine learning, and full population testing," J. Finance Data Sci., vol. 8, pp. 138–144, 2022. DOI: 10.1016/j.jfds.2022.05.002

J. Kommunuri, "Artificial intelligence and the changing landscape of accounting: A viewpoint," Pac. Account. Rev., vol. 34, no. 4, pp. 585–594, 2022. DOI: 10.1108/PAR-06-2021-0107

M. A. Agustí and M. Orta-Pérez, "Big data and artificial intelligence in the fields of accounting and auditing: A bibliometric analysis," Spanish J. Finance Account., vol. 52, no. 3, pp. 412–438, 2023. DOI: 10.1080/02102412.2022.2099675

T. Kukman and S. Gričar, "Blockchain for quality: Advancing security, efficiency, and transparency in financial systems," FinTech, vol. 4, no. 1, Article 7, 2025. DOI: 10.3390/fintech4010007

D. Leocádio, L. Malheiro, and J. Reis, "Artificial intelligence in auditing: A conceptual framework for auditing practices," Adm. Sci., vol. 14, no. 10, Article 238, 2024. DOI: 10.3390/admsci14100238

M. Reid, J. Stone, and P. Whittaker, "Machine learning-enhanced text analytics for efficient audit documentation review," J. Trends Financial Econ., vol. 2, no. 3, pp. 55–62, 2025. DOI: 10.61784/jtfe3056

N. Eisikovits, W. C. Johnson, and A. Markelevich, "Should accountants be afraid of AI? Risks and opportunities of incorporating artificial intelligence into accounting and auditing," Account. Horizons, vol. 39, no. 2, pp. 117–123, Jun. 2025. DOI: 10.2308/HORIZONS-2023-042

B. P. Commerford, A. Eilifsen, R. C. Hatfield, K. M. Holmstrom, and F. Kinserdal, "Control issues: How providing input affects auditors' reliance on artificial intelligence," Contemp. Account. Res., vol. 41, no. 4, pp. 2134–2162, 2024. DOI: 10.1111/1911-3846.12974

A. H. J. Alhazmi, S. M. N. Islam, and M. Prokofieva, "The impact of artificial intelligence adoption on the quality of financial reports on the Saudi stock exchange," Int. J. Financial Stud., vol. 13, no. 1, Article 21, 2025. DOI: 10.3390/ijfs13010021

J. Kokina, S. Blanchette, T. H. Davenport, and D. Pachamanova, "Challenges and opportunities for artificial intelligence in auditing: Evidence from the field," J. Inf. Syst., vol. 39, no. 1, pp. 75–102, 2025. DOI: 10.1016/j.accinf.2025.100734

O. N. Okeke and T. Akaegbobi, "Artificial intelligence (AI) and financial statement audits," Adv. J. Manag. Account. Finance, vol. 10, no. 9, pp. 138–155, 2025. DOI: 10.5281/zenodo.17176333

R. Liu, Y. Wang, and J. Zou, "Research on the transformation from financial accounting to management accounting based on Drools rule engine," Comput. Intell. Neurosci., vol. 2022, Article ID 9445776, 2021. DOI: 10.1155/2022/9445776

Downloads

Published

License

Copyright (c) 2026 Mu Jing (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.